oregon statewide transit tax rate

The ORTIF Oregon Transit Improvement Tax tax rate record was included in Payroll tax update 1809. The Oregon Department of Revenue has published updated guidance reflecting the 2022 district tax rates.

Wages of Oregon residents regardless of where the work is performed.

. When you set up the Oregon local taxes in QuickBooks Desktop the system automatically adds the Oregon Statewide Transit Tax rate which is 01. Choose Payroll Detail Review. 2022 oregon tax tables with 2022 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.

Lane Transit District LTD tax rate is 00077. 01 Date received. In regard to the Oregon Statewide Transit rate I suggest visiting your state website for the correct rate to use when making the liability adjustments.

Oregon Transit Payroll Taxes for Employers Following are the 2022 district transit tax rates that apply. Employers that expect their statewide transit tax liability to be less than 50 per year may request to file and pay the tax annually instead of quarterly. On July 1 2018 employers began withholding the tax one-tenth of 1 percent or 001 from.

Employers pay 07937 up from 07837 in 2021 of the wages paid by an. Statewide Transit tax STT rate is. Heres how to figure interest.

Check the box for the quarter in which the statewide transit tax was withheld. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Statewide transit tax rate is 0001.

Go to the Reports tab and select Employees Payroll. Oregon employers must withhold 01 0001 from each employees gross pay. 2020 Form OR-STI Oregon Statewide Transit Individual Tax Return Instructions 150-101-071-1.

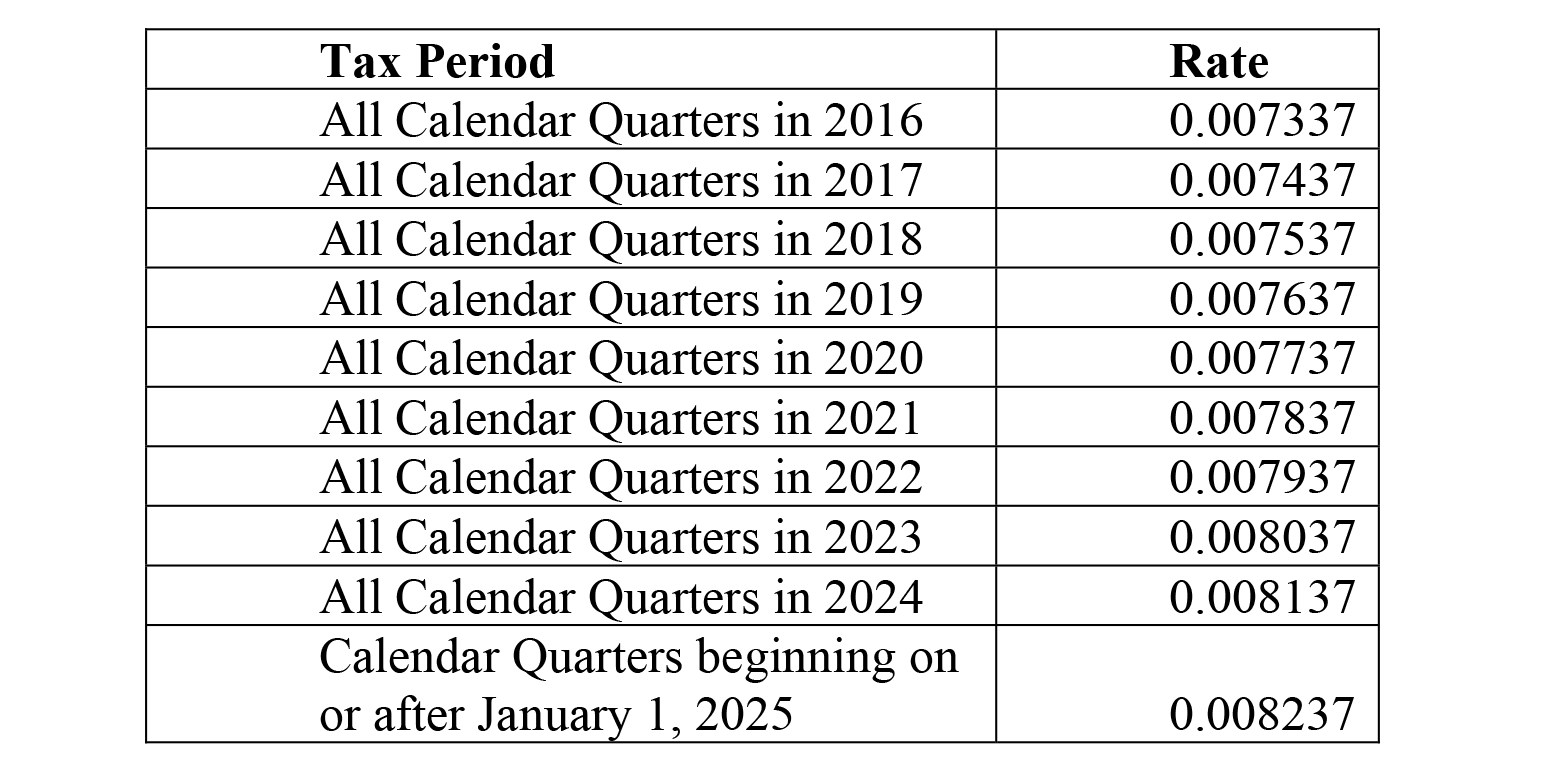

The Tri-County Metropolitan Transportation District Tri-Met tax rate is to increase to 07737 up from 07637 in 2019 and the Lane County Mass Transit District LTD tax rate is to increase to 075 up from 074 in 2019 the department said on. Cigarette and tobacco products tax. Two Oregon local transit payroll taxes administered by the state are to have their rates increase for 2022 the state revenue department said.

Transient lodging administration page. Oregon Transit Payroll Taxes for Employers A guide to TriMet and Lane Transit Payroll taxes 150-211-503 Transit self-employment taxes 150-500-406 Author. This tax is NOT related to the Lane or TriMet transit payroll taxes it is in addition to all other local tax codes for.

2017 enacted in October 2017 established a new Oregon Statewide Transit Tax which employers are required to deduct from wages beginning July 1 2018. The tax will need to be added to the tax group to calculate automatically. Lets run a Payroll Detail Review report to check your employees tax deductions.

The transit tax will include the following. In calendar year 2021 the lane transit district tax will be increasing from the current0075 to0076. Interest is charged daily starting the day after the due date.

A Statewide transit tax is being implemented for the State of Oregon. Billing notice the interest rate increases to 8 percent 008 per year. There is no maximum wage base.

This tax must be withheld on. Statewide Transit Tax will be included. The state transit tax is withheld on employee wages via tax code ORTRN.

Oregon withholding tax tables. Aatrix will be supporting the new Oregon Statewide Transit Tax which takes place July 1st 2018. T he effective date for this tax is July 1 2018.

Transit payroll tax is imposed only on that portion of the payroll. Return and payment are due by April 30 2022. If your income is over 0 but not over 7300 your tax is 475 of the Oregon taxable income.

The Tri-County Metropolitan Transportation District Tri-Met tax rate is to increase to 07937 from 07837 and the Lane County Mass Transit District LTD tax rate is to increase to 077 from 076. Currently QuickBooks Desktop doesnt have the ability to e-file the Oregon Transit Tax form. Tax to pay See payment options for information about submitting your payment.

Round to the. Heres how to do that. The tax will need to be added to the tax group to calculate automatically.

The tax is not related to the local TriMet transit payroll tax see below for info on local Oregon transit taxes. 11111 e 3121 Page 2 of 3 Fo nstruco Line 2. If your income is over 7300 but not over 18400 your tax is 347 65 of the excess of 7300.

Tri-County Metropolitan Transportation District TriMet. The new law requires employers to deduct the Transit Tax at a rate of 01 from. All wages paid to Oregon residents regardless of their work location.

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. A statewide transit tax is being implemented for the state of oregon. I also suggest following the resolution provided by ShiellaGraceA.

This tax will be strictly enforced and employers could face penalties if they do not withhold this tax in a timely manner. TriMet Transit District rate 1114 to 123115 0007237 1116 to 123116 0007337 1117 to 123117 0007437. The Oregon statewide transit tax rate remains at 01 in 2022.

Named Frances will replace the Oregon Payroll. Employees become subject to this new tax on July 1 2018. In September 2022 OEDs new modernized system.

The statewide transit tax is calculated based on the employees wages as defined in ORS 316162. 2 wages paid to nonresidents of Oregon while they are working in Oregon. The daily rate is 00110 percent 0000110.

Withhold the state transit tax from Oregon residents and nonresidents who perform services in Oregon. The Oregon legislature recently passed House Bill HB 2017 which creates a new statewide transit tax on Oregon residents and nonresidents working in Oregon to fund state highway upgrades. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

News Pacific NW Oregon closing in on vaccination goal and reopening economy. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. The futa rate after the credit is 06.

Tax Multiply the amount on line 1 by 01 0001. Frances OEDs new modern system. If an employee is an Oregon resident but your business isnt in.

Wages of nonresidents who perform services in Oregon. Tax deductions are available for some adaptive equipment. January 1 2022March 31 2022.

The tax rate is 010 percent. Department regulations require employers to report the Oregon statewide transit tax in Box 14 of Form W-2 with the designation ORSTT WH for example ORSTT WH - 1500. Oregon Statewide Transit Individual Tax Return Instructions 2021.

Oregons transit district payroll tax rates are to increase for 2020 the state revenue department said Dec. Reporting System OPRS beginning with the third quarter filing of 2022. 1 wages paid to residents of Oregon regardless where they work.

The annual interest rate is 4 percent 004. The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018.

Oregon Transit Tax Procare Support

Wfr Oregon State Fixes 2022 Resourcing Edge

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax How To File More

What Is The Oregon Transit Tax How To File More

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support